Home Insurance in Ontario: Where It’s Cheapest & Costliest

A recent RatesDotCa Home Insuramap report, covered by Canadian Underwriter on June 26, 2025, reveals notable contrasts across Ontario’s landscape.

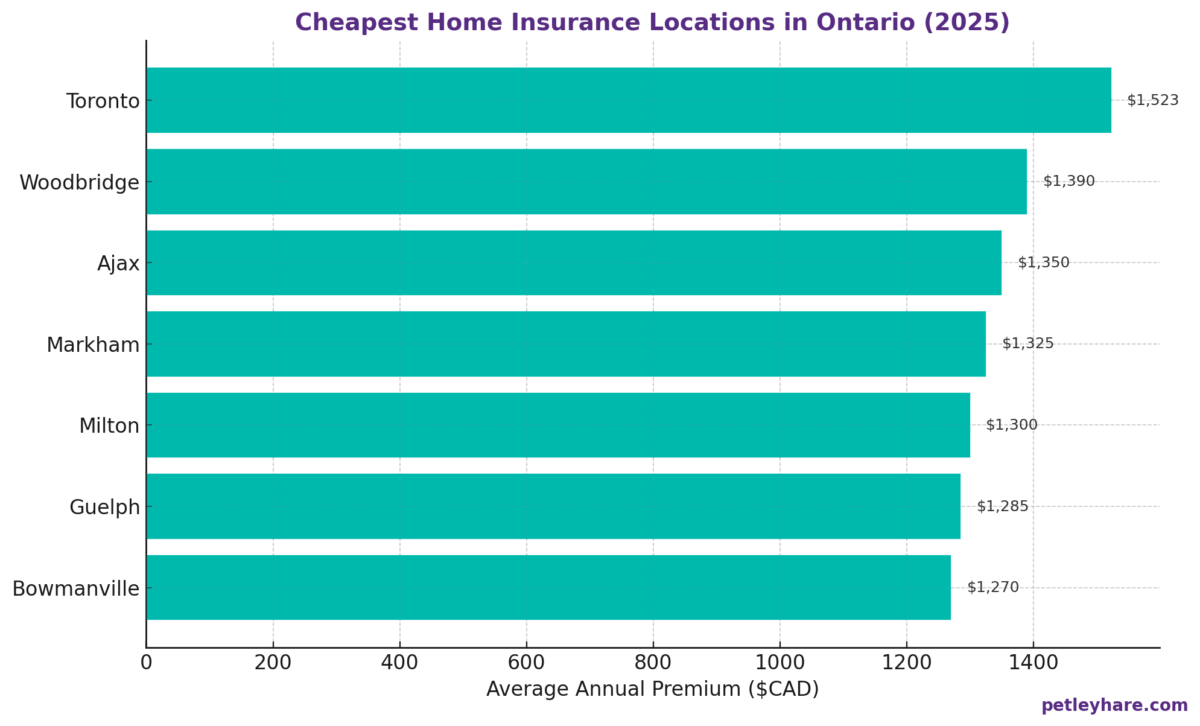

Where Home Insurance Is Most Affordable

Homeowners in the Greater Toronto Area (GTA) enjoy some of the province’s lowest annual premiums:

- Toronto: $1,523/year—right in line with the provincial average of $1,565.

- Other low-cost cities (15–34% below Ontario average): Woodbridge, Ajax, Markham, Milton, Guelph, Bowmanville, and more.

These urban and suburban areas benefit from:

- Proximity to fire services and hydrants.

- Lower climate risk—urban centres face fewer wildfires or remote-area weather events.

- Competitive market—more providers, better pricing.

Where Premiums Are Highest

On the other end, northern and remote Ontario sees home insurance premiums balloon:

- Red Lake: $2,873/year—84% above the Ontario average.

- Top 10 costliest areas include: Red Lake, Sioux Lookout, James, Ingolf, Minaki, Wawa, and Timmins (population 40,000).

Why so high?

- Greater exposure to wildfire, flooding, and extreme weather.

- Distant firefighting services → slower response, higher risk.

- Higher repair/rebuild costs, due to logistics in remote regions.

Broader Market Trends

- Provincial average: $1,565/year.

- Northern premiums run 30–80% higher compared to southern Ontario.

- NatCat (natural catastrophe) claims soared in 2024 to $9.1 billion, fueling premium inflation.

- Nationwide home insurance rose 5.3% in 2025; Ontario rates have been up 10% since late 2021.

What This Means for PetleyHare Clients

- Urban residents (GTA & surroundings) should expect relatively affordable premiums, but annual increases remain around 4–17%, driven by weather and inflation.

- Rural/northern residents face significantly higher costs—often 30–80% more. New policies there should highlight:

- Risk exposures (fire, flood).

- Proximity to services.

- Rebuild logistics and costs.

- All residents: We encourage regular comparison shopping, as your PetleyHare broker can uncover value even amid volatility.

Tips to Help You Save on Home Insurance

- Bundle your policies: Combine your home and auto insurance to unlock discounts and streamline coverage.

- Review your coverage yearly: Make sure your policy reflects current rebuilding costs and any recent upgrades to your home.

- Improve your home’s safety: Install monitored alarms, sump pumps, or backwater valves to lower your risk—and your premium.

- Ask about discounts: You may qualify for savings if you’re mortgage-free, claims-free, or a long-time customer.

- Protect against local risks: If you live in a flood-prone or wildfire-exposed area, consider additional coverage to avoid surprises.

Final Thoughts

Ontario is far from uniform in home insurance costs:

- GTA & suburbs: competitive, lower premiums ($1,500/year).

- Northern/remote locations: premiums can exceed $2,800—double the provincial average.

By educating clients on the why behind these differences, and leveraging smart coverage and mitigation strategies, PetleyHare Insurance Brokers can position itself as a trusted advisor—cutting costs where possible, explaining premium variability, and building long-term relationships. Contact us today!